You think having a newborn kills sleep?

Try adding leverage to your portfolio... February -1.1%, YTD -2%

Well that was a sucky month. My headline number of -1.1% sounds like nothing much happened, but in truth, everything happened in the first half and then everything kind of “unhappened” in the second half. I was up 12% YTD on Feb 18th, and since then lost 14% to finish February with a -2% YTD figure. This is worse than the SP500 and QQQ YTD figures, and a tad better than the IWM shit basket. Hooray, I guess?

You may recall from the last update I started playing with margin in the middle of January and discovered a law of financial markets previously unknown to me: Sleep quality declines exponentially with the degree of leverage applied to one’s portfolio.

I know, cause I yanked up leverage to 1.54x in its peak and boy, that did not serve me at all. It’s now back to 1.33x and I think that is probably still too high given I only have long positions and the market … kinda … sucks? It feels extremely heavy and the only thing that makes me think we won’t have a huge sell off, is that everyone seems to be expecting one. And the “fade everything” rule says nothing ever happens that everybody expects. Then again, it may just be my very smart twitter bubble that expects the drawdown and I should listen … especially as I feel that fate has been very kind to me given that I was “only” down 1.1% in Feb and that is not worse than the indices, better actually, despite having been levered long on average by 40% or so… So maybe I should just say “thank you, market gods” and reduce leverage to 0.75x until the market sits 25% lower? If only margin wasn’t so hard to resist by a brain conditioned to “markets always go up”…

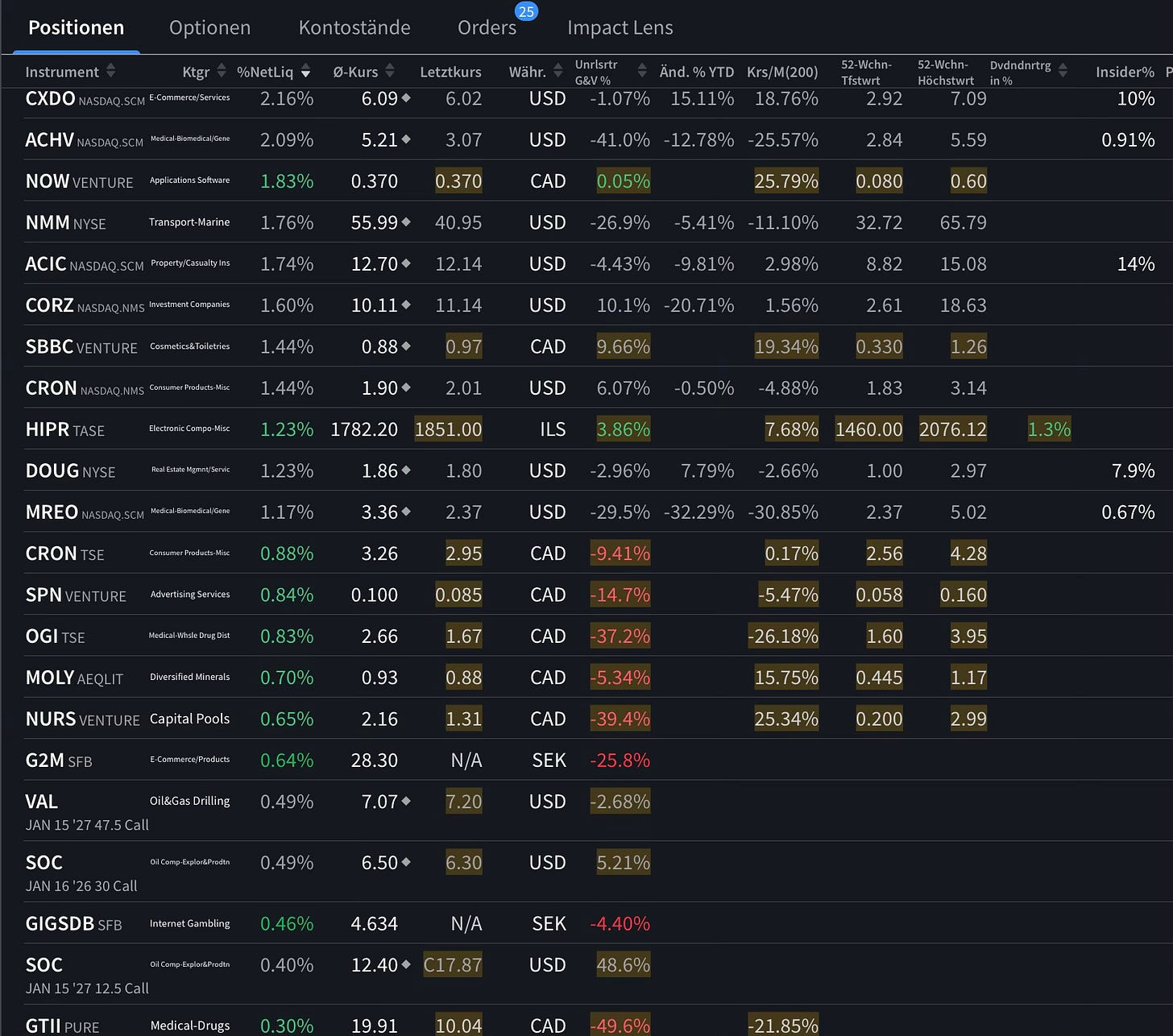

Anyhow, below is the portfolio. The things I feel best about are SOC, GBFH, NN, ZOMD, RBI, and NOW.V though that does not say much, given loosing 14% in the past 10 days has left me feeling very unnerved about everything really. The only exception is SOC which should probably be twice as large as it is, but then again SAVE taught me that even the weirdest things do happen and the SOC downside is scary AF.

Until next month,

Friendly

Disclaimer: Nothing I have written herein should be construed as financial advice or any other kind of advice. I do not recommend to buy or sell any securities mentioned. I do not know what I am doing, so please, be responsible and simply view these ramblings as the entertainment that they are meant to be. Nothing more. Thank you.

SOC should be finishing up repairs right about now if the Jefferies timeline is right. Hydrotest should be getting rolling soon.

I'm not a crayon eating chart guy, but if we get a gap fill and it goes to $25 with no news or changes, I'm punting on more calls.

Any material change in $AERG? That made you sell?