I was bearish going into May. Naturally, markets continued their relentless move up like Duracell bunnies. I don’t get why, to be honest, except the old adage that bull markets “climb the walls of worry”. I see so many reasons to not be bullish:

Persistent Inflation and Federal Reserve Policy Uncertainty: Inflation remains a primary concern, potentially delaying Federal Reserve interest rate cuts. Analysts note that inflation above the Fed’s 2% target could lead to tighter monetary policy, increasing borrowing costs and pressuring corporate earnings, particularly for growth stocks. The Fed’s decision to pause rate cuts in early 2025, maintaining rates at 4.25%-4.50%, has already contributed to market volatility. If you listened to Powell’s last statement you know that even rate hikes are a possibility.

Trade Policy and Tariff Impacts: Trump’s aggressive trade policies, especially the sweeping tariffs announced in April, are a negative influence on the US economy no matter how you look at it (just look at the sharp market decline that they caused…). While a temporary pause in tariff increases spurred a rally, ongoing U.S.-China trade tensions and potential retaliatory tariffs from other nations (e.g., China, Mexico, Canada, the EU) continue to threaten economic growth and corporate margins, potentially shaving 0.7-1.1 percentage points off U.S. GDP. It makes zero sense to me that the market should now be higher than before the tariff announcements, with this threat weighing on the economy.

Market Concentration and AI bubble: The U.S. stock market remains heavily concentrated, with the top 10 stocks, primarily mega-cap tech firms like Apple, Microsoft, and Nvidia, accounting for over 20% of global market index value and 36% of the S&P 500. Mixed earnings results from these firms, such as Microsoft’s slower Azure growth and Meta’s weaker sales forecasts, have raised concerns about overvaluation and reliance on the AI-driven rally. A correction in these stocks could drag down broader indices. And what if AI isn’t the route to the promised land in the end? I know, a heretical thought… Maybe I listen too much to Ed Zitron. Look, I really don’t know on this AI thing, but it seems to me that markets need AI to not be a bubble…

Overvaluation and Limited Upside: The U.S. stock market is trading at 22x P/E roughly, right? Maybe not “priced to perfection”, but pretty close to perfection I’d say. I do not understand why such a valuation is justified with this economic backdrop, unless AI produces a huge productivity boom (it might) or Kuppy’s “project Zimbabwe” is actually playing out (again, it might).

Geopolitical and Policy Uncertainty: The Trump administration’s unpredictable policy landscape, including potential immigration restrictions and fiscal policies like extending the 2017 Tax Cuts and Jobs Act, could increase deficits and inflation expectations. Geopolitical risks, such as escalating conflicts in Ukraine or the Middle East, may disrupt supply chains, driving up commodity prices and inflation. These factors could further unsettle markets. And a China-Taiwan conflict could be just 1-2 years out… What happens if we get a strong inflation spike? Yes, Trump will replace Powell soonish, but can, whoever comes next, really deliver lower rates to Trump if inflation spirals out of control?

Rising Recession Fears: Weakening U.S. economic data, including declining consumer confidence, retail sales, and manufacturing activity, has raised recession concerns. The Atlanta Fed’s GDPNow model estimated a 2.8% annualized growth decline for Q1 2025, and an inverted yield curve in February 2025 signals potential economic contraction. Maybe Tobi from Value After Hours will finally get his recession? I certainly would not be surprised given all the tariff-related uncertainty affecting businesses.

Bond Market Volatility and Fiscal Concerns: A spike in bond yields in April 2025, with the 10-year Treasury yield hitting 4.5% and the 30-year yield jumping to 5%, reflects waning confidence in U.S. fiscal policy amid tariff-driven inflation fears and rising deficits. I am too stupid to understand the ins-and-outs of it, but I do understand that 1) the US fiscal deficits and debt burdens are unsustainable, 2) the US needs to roll a lot of debt very soon, and 3) the price for doing that keeps going up and up and up, and 4) the rows of potential buyers for said bonds get thinner and thinner. Seems like something could break here? How does that affect markets? I don’t know. Will it be positive? Hard to imagine.

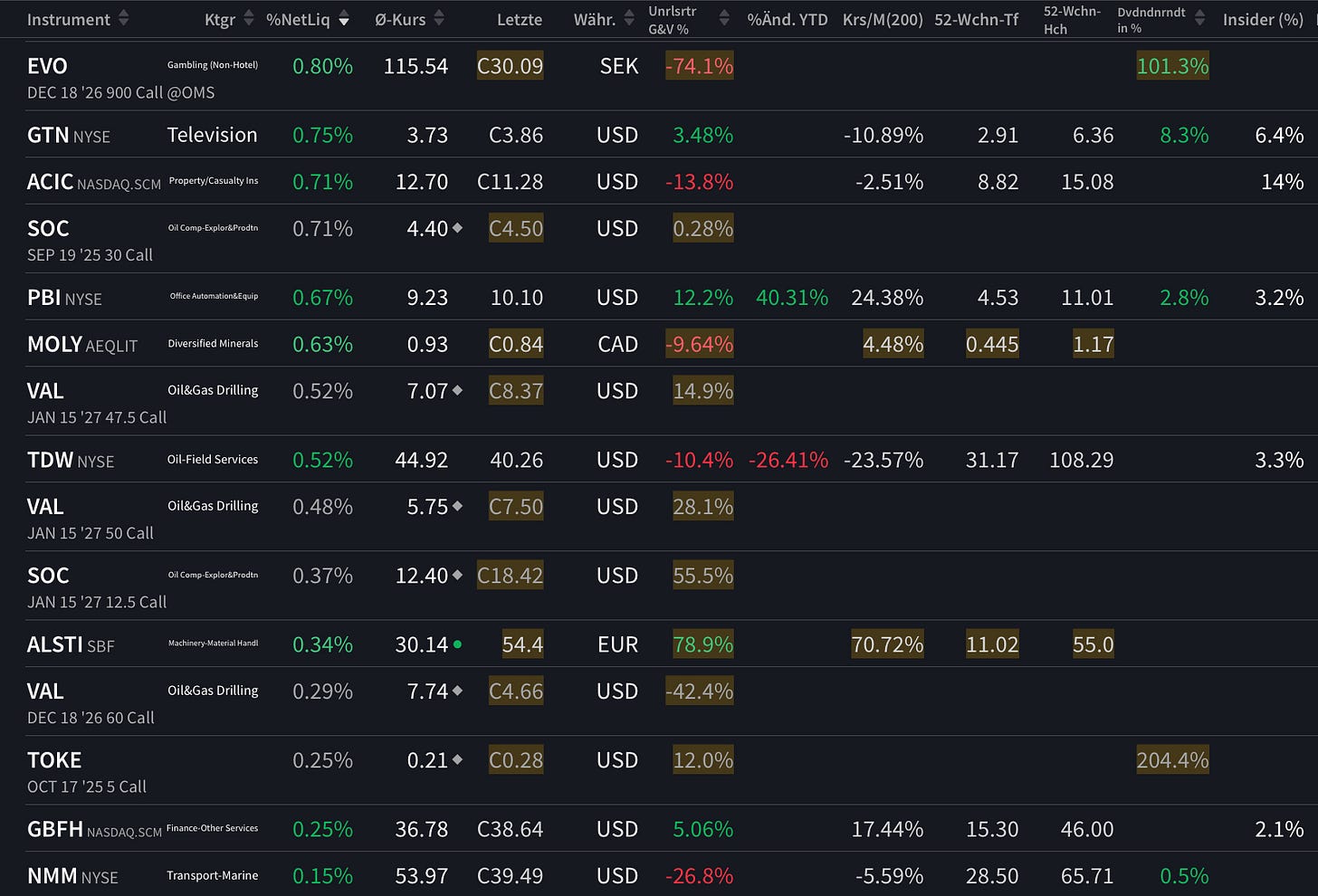

There you have it. I think there are tons of risks and markets are too high in light of this. Consequently my positioning has not changed. I don’t like investments here that are highly dependent on the economy. Instead, I still like $SOC, $GLASF, $NN, $INMB, $LWAY etc. You know, things that are special situations or don’t need the economy to do well to flourish ($GLASF).

So here is the portfolio. My portfolio’s performance will be highly dependent on the decisions of the OSFM in California, 5 guys at the FCC, Matt Zorn’s impact in Washington, and the outcome of a Phase 2 trial of an AD drug. It’s funny that I think I have better odds going up against Alzheimer (no drug has ever worked and phase 1 of XPro was 7 patients or so) and the anti-oil lobby in California, than to put my chips on the US economy as a whole right now. But there you have it - I said I was bearish, I guess this proves it.

Finally a word on performance. Obviously I am not excited by my performance YTD, but it is what it is. Given the big own goal that I scored earlier this year with my adventures in margin trading, I certainly don’t deserve any better. In hindsight I find it funny how I knew that everyone levers up at the top and delevers at the bottom and still I did the same. While paying it remains annoying, I just hope that this “tuition” is a good investment long term and I manage to have the lesson stick. [Fast forward 6 months: Should Sable end up in a clusterfuck, I already see myself writing “In hindsight I find it funny how I knew that concentration kills investors and still I put 50% into Sable…”]

Stay safe out there,

Friendly

PS: You don’t see an INMB position in the portfolio above cause it is in a different account (in which I hold also even more SOC, and VAL…)