Disclaimer: Nothing in this post is financial or any other type of advice.

Let me preface this with me saying I would love your feedback on the contents of today’s update. I am going to write about a trade I did on October 31st after hours, which in hindsight clearly was a mistake. At the same time, I am not sure whether in real-time it really was a mistake, and I would like to hear about your thoughts on this, if you have any.

So what happened: In the last 30 minutes of trading on October 31st, I began writing this update. Here is what I wrote at the time:

I remember 13 months ago, I wrote my September ‘23 update from a train. I can recall it very well - I wrote about my 3 biggest positions at the time, and I was in very good spirits. I was up 21%+ while the SPX incl. dividends stood at 13%. … I finished the year with 15%+ while the SPX incl. dividends ended at roughly 26%. I am writing this from memory, so excuse the rounding errors, but you get the point: I got my ass handed to me towards the end of the year while the market absolutely ripped.

I am reminiscing about this now, cause I find myself in a similar position at the moment. I have been destroying the market so far this year, up ca. 50%+ while the market sits at less than half this figure. Even more satisfying, my monthly beta is negative to the market and daily beta is fairly low as well - an absolute dream of an outcome.

However, Q4 ‘23 memories still haunt me and I am somewhat worried that history will reshit itself. It would obviously annoy me if I squandered my performance this time around again, so I am trying to figure out if there are any parallels to last year that I should act on now to protect my PnL. Last year the big kick in the balls was giving back all my gains on a position in a shitco that had reached 80% of fair value and that had more than doubled on me (Hello ALTO 0.00%↑ my old friend)… which then reported a set of ridiculously terrible earnings that initially paralysed me with self-hatred so that I rode it all the way back down. I also had a few eventy names in the book whose events - surprise, surprise - never happened. Then some oil producers which also took a massive beating.

If I look at today’s portfolio though, I luckily see no such obvious risks. Yes there are some eventy names in there and one of them I am already more than 300% up on ($NN - I bought my position at 3.76, sold at 9, repurchased it at 8.18 and it now stands at 11.68 as I write this) so this would normally be a prime candidate for cutting. The difference to ALTO last year is that 1) insiders are actually very long this name and have been buying, with cash, until the recent run-up, 2) the team of insiders is of much higher quality than insiders at ALTO, and 3) it is a binary name which could have an outcome that may see the stock rally another 100 or 150% from here. So to me, this justifies not cutting it here - though of course, if the binary decision comes in with an unfavourable result, I will eat a huge loss here.

The other obvious “eventy” name I guess is $ACHV. Yes, I own it cause I am expecting they will monetise their smoking cessation drug with a transaction in 2025 that should see the stock multiples higher from here. And yes that may not happen and the drug may end up not worth anything. Unlikely, but definitely in the realm of possibilities. And… if ACHV was trading at $13, I would very likely take it out on the spot. But it’s trading at 5ish, … which seems like a very reasonable price relative to the fundamentals.

Other eventy names in the book are sized below 2% and not worth talking about. I have almost no oil & gas left, but the positions are tiny and these companies are so cheap and have so much upside that if anything I feel I should size them up, rather than reduce them even though I am actually bearish oil going into 2025 due to the very large OPEC spare capacities.

So what’s my ALTO this year? What’s the shitco that will blow up in my face? The big risk that I am not seeing? Please let me know (I am aware there is a US election and yes, that may lead to a sell-off, but … it shouldn’t lead to the market catching up to me in terms of performance over the next 2 months, especially given my very low beta?)

Right? Right??

So this is where I was when the market closed on October 31st. I made the mistake of glancing at my portfolio and suddenly saw my PnL for the day evaporate and then some more: Within seconds I had lost in excess of 1% of portfolio performance. I checked the culprit and saw it was $ASPI, which was my biggest portfolio contributor in recent weeks: I had bought a circa 2.2% position at $2.21. The stock closed at $7 on October 31st - so you could say it was a great investment up to that point. But now, after hours, it hit $5.8 and then hovered around $6.20 on a news item that they would do a dilutive share offering. The PR neither included the number of shares nor the Dollar amount that they were looking to raise.

I was shocked by this. Based on management commentary on past calls, I was under the firm impression that no more dilutive raises would be forthcoming. They had very clearly led investors to think that way. In addition, a day before they had issued a PR about a new contract and plant that they were planning to construct and also in that PR they went out of their way to say that no dilutive share offering would be needed to construct the plant. Yet in spite of this, there was now this PR saying a dilutive offering is forthcoming (albeit for a different purpose than the aforementioned plant).

So you could say, I felt very betrayed by this share offering. I also was extremely concerned that they made the press release but didn’t offer any useful details: how many shares and at what price? What the fuck is the point of scaring the market like this? I quickly reached out to a few other shareholders and all of them were “shocked” (sic). What left an even worse taste in my mouth was that Canaccord would act as book runner for the offering. Cannacord had issued a super bullish note on ASPI 0.00%↑ the day before where they had raised the price target by almost 100%. It all felt like a bad joke: Cannacord pumps the stock, management goes out of their way making shareholders believe dilution is a thing of the past, and then they put out a release informing the market about a share offering of unknown size and at an uncertain price…

What the actual fuck? I sent out two tweets to vent my anger (which I can’t figure out how to embed here… ?) but obviously that did not help to make the situation any better.

So all this happened immediately after I had begun writing the above update to you guys. So I was all in a mindset of “what’s going to go wrong this time?” and “where will I give back all my performance this year around”? I was in a mindset of paranoia already, and then the ASPI 0.00%↑ clownshow happened… You see with ALTO 0.00%↑, I had plenty of opportunity to check out at an 80% gain even after the ER hit in October 2023. There was plenty of liquidity above $4 after hours. But I did not sell then, cause I was paralysed. Instead I sold the next day at $2.25, basically checking out of the name break-even. I felt miserable for a week cause of this.

I didn't want to repeat this. I felt betrayed by ASPI management and I saw a chance to secure PnL above $6 on a position that I had bought 2 months prior at $2.21 - so I in a “safety first” mentality sold my entire position at $6.15. I did not believe the stock would fall back to $2 on the offering, but I was concerned it could open at $4 on November 1st.

Long story short: The next day already before market open, another PR was published with the size and the price for the offering: 16m USD worth at a price of $6.75 per share. Again I was thunderstruck. The offering was small and the price was amazing - less than 4% below the close of October 31st. My sale looked like a big mistake immediately with shares trading up to $7.50 in short order.

I was fuming. Why the fuck did management handle it this way? Why issue a PR about the offering without size and price IF a few hours later you issue another PR that includes size and price? Why do that? The only thing they did was create uncertainty and fear. I was extremely pissed.

Despite hating management (and myself) at this point, I rebought the position pre market at $7.43. I had lost 17% of my shares through this in-and-out trading, but I felt better to repurchase my shares than being stubborn and watch ASPI continue to ascend like the rocket ship it has been without having a position. My experience tells me that when you have something going up like ASPI has been, you just want to be long, and staying out of it out of “principle” cause I let myself get fucked over by them, would carry the risk of me feeling continued bitterness every time I look at the ASPI share price in the future. Better to have fewer shares of something going up in a straight line than having none at all.

Now, I would be lying if I said I ain’t still pissed about the entire thing. I am wondering whether I made a mistake in real-time (with the benefit of hindsight I clearly did!)? If I had just logged off and not been aware about the after market PR, I would not have sold. Also, if I hadn’t been writing this update in the 30 minutes before, which had put me in the state of ‘loss-aversion’ paranoia by reliving the ALTO experience, I might not have sold either. So has writing this blog cost me 2-3% of portfolio performance (and more if ASPI keeps going up)?

What do you think about this? What learnings can I take from this? I am very curious to hear anyone’s thoughts.

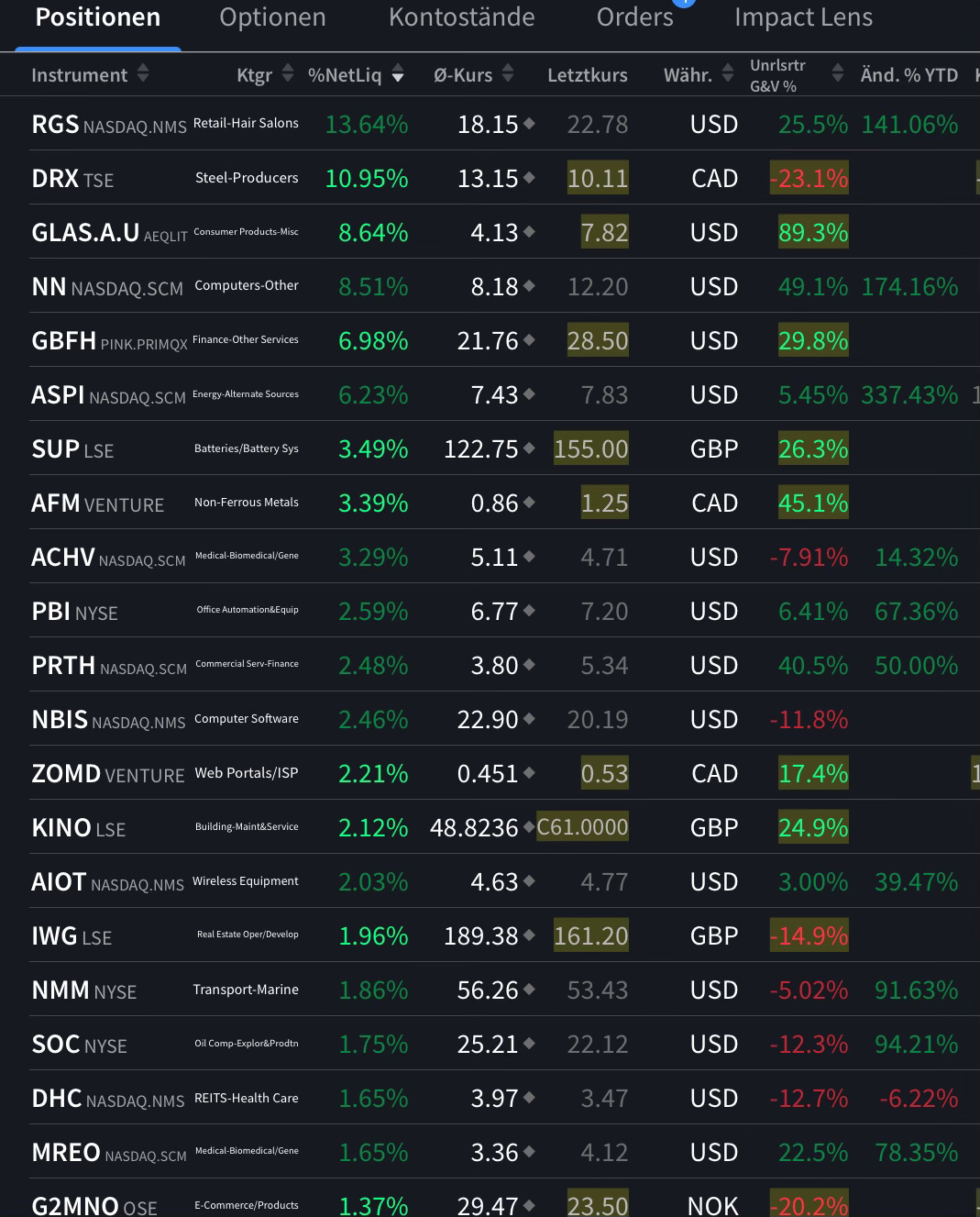

If you’ve only come for the current portfolio, then here you go. As always this is not to be construed as financial advice or a recommendation to buy or sell any security. Don’t forget, I am just a stranger on the internet and I have no idea what I am doing:

For those interested, here are my YTD portfolio KPIs (monthly):

Again, I am looking forward to hearing from you. All the best,

Friendly