lol no one know wtf is going on … I am increasingly convinced of that. Least of all: Me. As always, none of this is investment advice of any kind. All my posts are just entertainment.

It feels like it was a crazy month. But in reality, it wasn’t. The SPY is up 3%. My portfolio did worse, down almost 1% (up 1% if I include my 10% positions in EC 0.00%↑ and VAL 0.00%↑ which I hold outside of the FCM account as announced in last month’s post).

FED meeting, Trump inauguration & executive orders, national emergency declaration, earnings season, Deepseek, and now, a global trade war with tariffs. The market hasn’t even opened for February and my portfolio is down 1% MTD. It is quite funny that January was the month that I finally decided to begin playing around with leverage. I am 25% levered, so 125% net long at this point. I know, it sounds like absolute lunacy with everything that is going on, especially after 25%+ back-to-back years for the SPY.

Why do it - given it is a clear change of mind to what I previously said?

Cause I now arrogantly think that my stock selection leads to better-than-market returns, so even if the market treads water, I might be able to recoup the margin cost through better stock selection. 2024 was a wake up call for me in that regard. I do not think I can repeat 70%+ returns, but I really do think I can do better than the SPY… having murdered it last year and having beaten it by 13%+ or so even during the 2022 down year (despite having made - with hindsight - ridiculous mistakes back then).

Well, I think the bears have it likely wrong. US market dominance will continue, Trump will create even stronger economic growth in the US than they already have, Deepseek will lead to more, not less, AI which should benefit the US more than anyone else, and the trade war is a huge fade. I think it is likely that Trump will announce very soon that he’s had “great meetings with Canada and Mexico”, that he’s achieved “a great deal” that is “fair to the United States”. I think this could happen very soon (i.e. in the next few days), but firmly expect it to happen at the latest by summer. It makes absolute zero sense to me that Trump will not be able to bully the rest of the world into deals that will be widely favourable for the United States, and it makes even less sense to me that Trump will want a huge inflation spike on his watch. Hence I want to be long in an aggressive way, betting that this is all just scare that will evaporate. Also, if you watch the markets behave: they seemingly don’t want to go down. It seems very clear, that no matter the headline, they keep bouncing back up. I think there is a hidden signal there somewhere even if I can’t articulate it…

Having said this, please keep in mind, I know nothing, have lost money in January and am losing money in February so far. I must reiterate that this is not financial advice of any kind. I could very well be wrong and what I have written above could be the words of a stupid bag holder who is unwilling to change his mind and admit that he let greed become the better of him and he picked the wrong time to get levered long. It is actually very likely that this is the case. So. You have been warned.

Quick portfolio update:

I averaged up in GBFH in anticipation of the uplisting which should lead to strong passive buying, which should be bullish for such an illiquid stock.

I continue to hold RGS cause I think it is cheap here, but I do not expect fireworks around earnings (I hope to be wrong on this but I have learned that the retail-heavy trading in RGS will just always disappoint me in the end). But I think it’s too cheap to sell and very uncorrelated from macro (though lower rates would help the debt-stack).

I have a huge position in SOC, which is a big “multi bagger or bust” kind of gamble. This trade is an absolutely decisive one for me in 2025. If it doesn’t work, it will create a giant hole… but I like the risk/reward ever since the CEO traded his private jet to buy more shares - That’s the kind of insider conviction I want to align myself with.

I haven’t touched $GLASF, cause I love the management team and know that eventually it will work, but obviously the US cannabis story is one that I never would have thought could take as long as it has when I got involved 5 years ago.

I sold and repurchased PRTH, which was my best position after NN in 2024. I continue to hold both, PRTH cause it’s cheap; NN cause I hope for another multi bagger from here once the FCC approves (if the FCC denies the NN petition, the mark-to-market will be awfully painful). I bought both <$4 and think PRTH could be a double this year, NN could be a 4x or -80%.

Next on the list is $DRX.TO which makes me want to stop writing immediately :-) It was the biggest blunder in 2024, my PnL on this is just painful to watch and if I am wrong on the trade war, it could still get worse. It likely will get worse actually, given how silent management has become….

… Ok, $DRX.TO really killed my desire to continue writing this, so I will just publish it now.

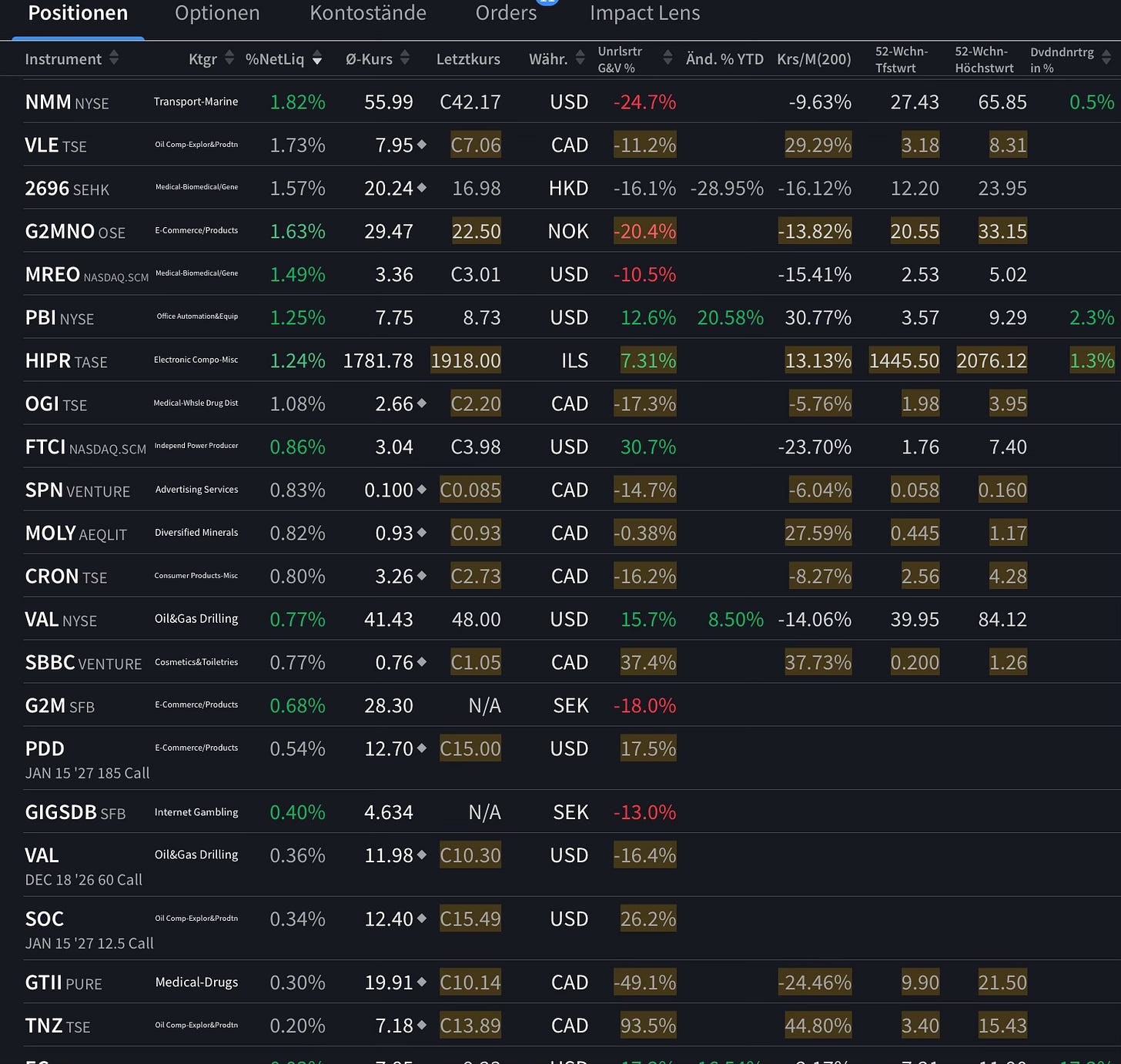

In the spirit of the original purpose of this publication, which is simply to share what I currently own to a few interested friends and acquaintances, here is the current portfolio:

All the best,

Your Friendly DRX.TO Bagholder

"Next on the list is $DRX.TO which makes me want to stop writing immediately :-) ...... … Ok, $DRX.TO really killed my desire to continue writing this, so I will just publish it now."

lol thought this was a joke then he just stops writing haha can feel the rage tilt.

the trade war ending and massive buybacks must feel good!

Spot on, trump had a very good conversation with Mexico and Canada.

Make 2025 great again.