It’s been a while since my last post. This is partly because I generally don’t do much in terms of buying and selling, and partly because the little trading that I did do last week was a bit… how to describe it... erratic?

Regular readers of this journal will recall I bought $EML.ASX towards the end of Q1 2023 at 51 cents. The stock had traded very strongly since and mostly hovered between 75 and 85 cents in the weeks prior to the earnings report on the heels of which the stock climbed another 30%. I immediately liquidated 2/3s of my position at 98.5 cents, and two days later took out the remainder at 1.14.

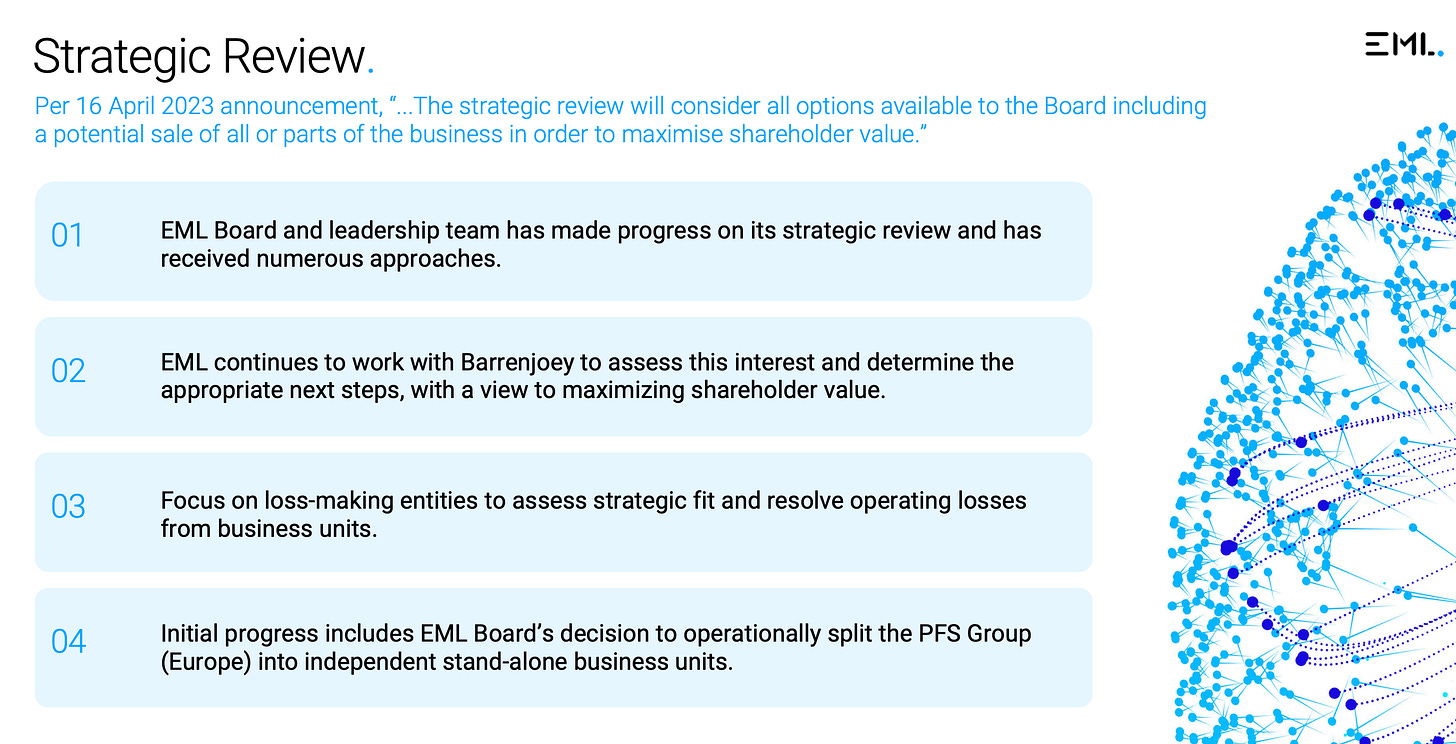

However, I have since changed my mind, and view my selling as a mistake. I have reallocated parts of the funds to a new position, but whatever is left in cash I will likely redeploy into $EML.ASX again. The reason is simple: After reviewing the earnings deck in more detail, it simply strikes me as highly probable that some sort of partial or whole sale of the business will occur by or before year end. The earnings deck states that quite clearly. See point 5 here

and point 1 here:

Given that the stock, despite my outsized gain of >100%, still trades below a reasonable SOTP valuation, and given that a very capable activist investor (Alta Fox) is overseeing the turnaround / sale, I think it is very likely that the equity will benefit from whatever transaction occurs here. Hence I now view my selling as a mistake that I rectified today buy buying back for 1.15.

Another situation of “erratic” trading which I sadly committed was the following: I had a small position in $MFD.ASX in the book which I thought was trading cheaply and I had been looking to increase. Hence a few days earlier, I submitted a limit buy order for 98 cents at IBKR. When I woke up on Friday I saw that my order had been filled at 96.5 cents while the stock was trading at 85 cents. What had happened? To my surprise $MFD.ASX had reported earnings on Friday morning (and to my further surprise, the earnings were bad). Earlier this week I had visited the company’s website to find out about the earnings date but absolutely nothing was scheduled - as far as I can tell, the report came out completely unannounced. To be fair, this probably saved me money, as if I had known about the earnings date, I would have probably FOMO-ed into the shares at north of a Dollar. Long story short, the earnings, management commentary and outlook were a disappointment and I am now looking to sell the entire position (parts of which are only a day old) again on Monday. Luckily, it was still small and hence low impact on my overall book.

Earlier I alluded to having bought 2 new positions. Those are VGR 0.00%↑ and $DRX.TO. In both cases I expect the next few earnings reports to materially beat market expectations and the stocks to rerate. As far as I can tell, the (hopefully) upcoming earnings beats have been more than well telegraphed by the management teams, yet the market is asleep at the wheel. Out of the two, I view $DRX.TO as the slightly riskier one (super complex steel construction for non-residential buildings in Canada sounds toxic in these times), but I think it trades cheaply enough to provide ample margin of safety. I am sort of trusting management here, who said that bidding has remained very strong and that the firms revenue backlog is bigger than ever. The next earnings report is this week, so we will know soon enough.

VGR 0.00%↑ is another simple case of the market not paying attention. VGR 0.00%↑ is now entering “harvesting” period of it’s main discount cigarette line: The company introduced the brand at extremely affordable prices and amassed market share (and customer loyalty) over a few years. They are now raising prices which will lead to massive margin expansion and a juicy pick up of EBITDA. This cycling strategy has been employed successfully by the company before, yet the market isn’t giving the company credit yet… I am betting that very soon that will change…

Overall the FCM portfolio stands at +16.7% YTD which is a satisfactory result given I did not own any of the Magnificent 7 this year. I am optimistic about the remainder of the year as many of my themes are springing to life now it seems: Uranium has broken out, Cannabis reform in the US is making credible progress, oil inventories continue to draw down (and the commodity continues to inch up), Kaspi (a 16% position now) will hopefully provide an update on the NASDAQ listing soon, etc… My portfolio seems fine (with the exception of ca. 5 positions which I hate and have sell orders submitted for…) The general market however in many cases seems stretched or priced for perfection. AAPL 0.00%↑is defacto ex-growth but continues to trade at a growth stock’s multiple. TSLA and NVDA… Boy, the urge to buy puts on $NVDA is gigantic, but the old adage applies: never short a bubble based on valuation. If idiots bid up $NVDA to $500, what is to stop them from bidding it up to $1000? Eventually it will come down and I will enjoy the implosion even without profiting from it financially :)